SAM Labs: Evangelizing the Problem

Summary:

Let’s start with the problem I had... SAM Labs launched into the US education market in 2018, after closing a series A round in 2017. SAM Labs then raised a second series A in 2019, on the back of new market growth and potential. The new funding did not lead to faster growth:

-

2019 annual revenue was down 20-25% YoY.

-

2020 Annual revenue was down 30-40% YoY.

This stood in contrast to the global edtech market, growing at roughly 20% YoY. The product lacked differentiation and organic appeal.

-

Qualitatively and quantitatively, they provided similar benefits to the financial buyer.

-

100% of our customers had purchased at least 2 of 7 major alternatives prior to SAM Labs.

-

Our ICP either had broken alternatives or hadn't implemented the alternatives yet.

Unable to win with brand, distribution, evidence, product differentiation, cash, etc. - I chose to evangelize the problem and create a unique POV. We began by championing of the problem our customers face, fabricating differentiation, trust, and domain expertise.

Step 1: The Why

For customer to purchase from a company, particularly in a B2B public sector setting, they must first trust the company. People are far more likely to trust, engage and empathize with another person than an organizational entity. The first thing I did was to encapsulate 'our why'. Why does SAM Labs exist?

This is the story. Well at least the prelude and first chapter. Us humans love stories and the best companies have a compelling origin story that appeals to their ICP. This was ours at SAM Labs.

Step 2: The Problem

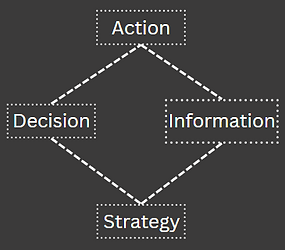

If folks understand why SAM Labs exists, the next step is getting agreement SAM Labs should exist. What is the problem? Is it worth trying to fix? In other words, this is the information war every new company should fight.

Written Content

If no one sees the content, was it published?

Distribute, distribute, distribute.

Fuel the marketing virtuous cycle.

Social Distribution

Search Distribution

The rationale behind the search and social activity was simple enough. Create 1x, distribute ^nth. Two channels we already had success in and plans to continue investment.

The mechanics are worth elaborating on.

The Big Idea

Sustainable and efficient growth -> stack paid on top of organic.

This was a result of two experiments.

Social

For content concepts, we would create organic posts and a set of ad variations. This seems like a pretty standard approach, tailoring the post to fit the tactic (paid/organic). After executing a few times, I felt this was a waste of time. I'm just lazy enough to find a better way, or at least explore efficiencies.

So I set up an experiment. I tested running the ad on the organic post itself compared to posts tailored for advertising.

And I was happy to find not only did the organic post ad perform better than the ad post ads, it also improved the organic performance.

-

Logically, this is due to the increase in engagement by funneling the audience to one post (decreasing the nodes in the network).

-

Cynically, this might be due to ad platforms showing preference for those who pay to play.

Search

The same process applied to search, we had our organic page and we would create ads around the same concept, driving to the same page or a conversion focused page. After the social experiment, I applied the same treatment to search.

I set up an experiment. I tested 3 treatments for keywords we were in the top 2 pages for:

-

1 page without any ads

-

1 page with tailored ads going after adjacent keywords

-

1 page with ads for the same keywords using the same copy as the organic result.

This experiment ran for a while to get enough signal (4-6 weeks). At the end, the results were clear. The ads that stacked on the same keyword, using the same copy performed the best. Surprisingly, the organic page underneath those ads outperformed the other organic pages (CTR change, traffic growth rate) for the same time period.

And that's the story of my tactic to stack paid on top of organic. And I rode that horse over and over again at SAM Labs.

Step 3: Present Unique POV

Now comes the fun part. Folks understand why you exist, and agree you should exist, naturally they want to hear your perspective.

-

If you don't have one, at this stage, you lose major credibility.

-

If you do have one, this is the chance to gain trust and alignment.

That being said, if the marketing is for everyone, it's actually for no one. So we picked a side and crafted a different, sharp, and noticeable POV.

This was operationalized in dedicated marketing assets and permeated all other customer interactions -

off-site, on-site, sales process, product onboarding, implementation, etc.

Below you'll find some examples of this POV in action!

Is Education Future Ready?